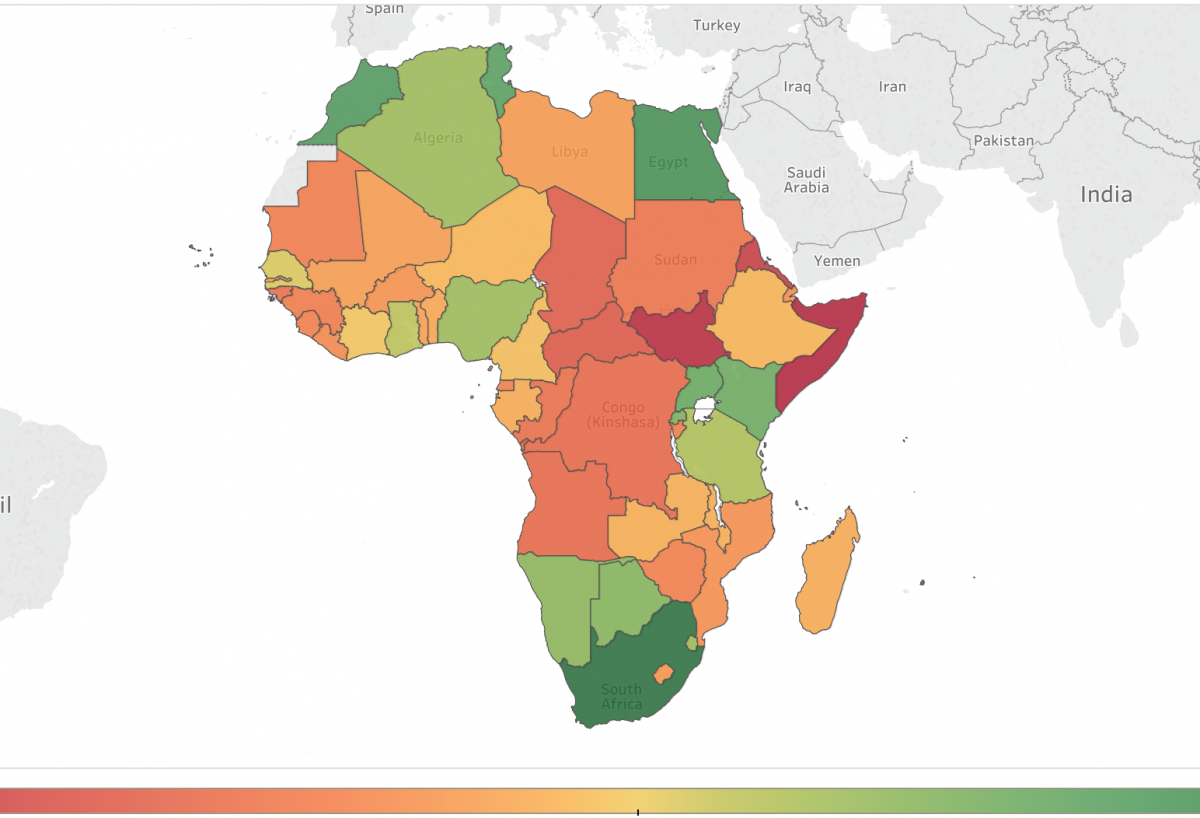

To support business development and sales managers in assessing which African country to prioritize in their organization’s expansion plan, we developed a tool (Business in Africa “Market Potential Index” – AMPI) that provides a quick way for managers to asses market potential across the African continent.

A lot of the information to determine which African countries to expand into is housed in different places. This can lead to a lot of time lost by businesses researching what markets hold the most potential for their organization. That’s the reason why we consolidated these important market data point into an easy-to-use visualization.

Our Business in Africa market potential index (AMPI) determines the market attractiveness across 50 African countries by measuring seven key metrics in critical areas of each country – economy, social-political landscape, technological adoption, infrastructural developments, and the efficiency of doing business.

These seven pillars act as key determinants to both the short and long-term market potential of each country.

The seven pillars, and their respective weighting factor, that make our market potential Index

Factors

Description

Weighting

Market Size & Appeal

This evaluates the size and appeal of the domestic market.

20%

Macroeconomic Resilience

Measures the stability of the macroeconomic environment.

20%

Political Landscape & Governance

Measures the quality of governance.

10%

Social & Human Development

Measures social development of the country.

10%

Investment in Technology, Infrastructure & Logistics

Measures the efficiency of technology, logistics, and infrastructure as a supporting base for the business environment.

15%

Economic Diversification

Measures the degree of dependence of the economy on the sectors and resources in the country.

10%

Business Ease

Measures the ease of doing business in the country.

15%

Market Potential Index

The weighted average of the seven factors above to determine the market potential of each economy.

100%

Within each pillar, a set of key indicators have been included with specific weightings to arrive at the overall pillar rank and score. The weighted averages of these seven pillars provide a starting point for country-by-country comparisons about business in Africa.

The first two pillars – market size & appeal and macroeconomic resilience – are short-term factors, and account for 40% of the total weighting.

The other five pillars are long-term factors and this account for the remaining 60% of the total weighting.

There are definitely no absolutes in the search for the best market to prioritize in Africa and exactly where to do business in Africa. There will be different answers for different organizations and industries.

As a result, you would know best what is necessary to asses the opportunities and risks for your organization’s growth plans.

Therefore, use this tools as a starting point to find the countries that fit properly with your company’s expansion strategy or to simply begin discussions within your organization about what countries to prioritize as you expand your business in Africa.

Africa Market Potential Index

The 7-slide visualization to guide on your business expansion efforts in Africa.