Africa is the second largest continent in the world with 54 countries. The vastness and diversity of the continent can be a challenge for businesses looking to expand across the region. However, if you have a good understanding of the flows of supply chain in Africa, you will be properly positioned to lead the charge for your organizations international expansion in the region.

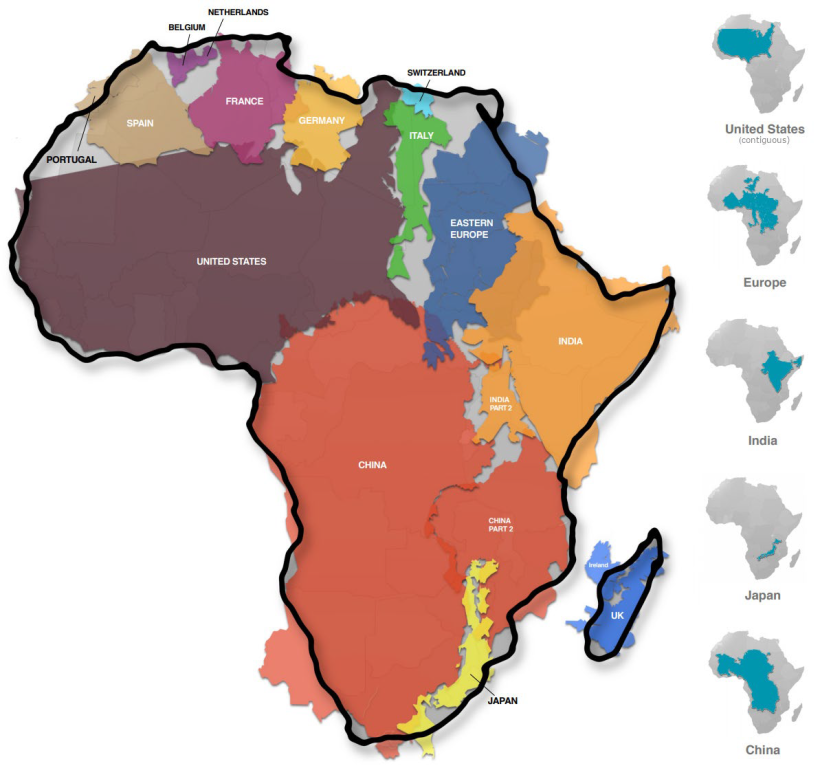

Let’s start by putting the size of the continent in context.

It is 3 times the size of the United States of America. The entire continent can contain the US, Europe, China, India, and Japan combined within its borders.

Accounting for 16% of the world’s human population, the vast continent holds 1.3 billion inhabitants with the youngest population across the world.

These diverse countries interact with one another and with other continents in a unique way, presenting a lot of opportunities for innovation but also challenges for business developers looking to expand across the continent.

With varying levels of macro-economics, socio-political developments, infrastructure, and currencies across different countries, having a clear and coherent supply chain in Africa can be difficult.

However, with clear understanding of the flows of supply chain across the continent, Africa can be the next frontier for most global organizations.

With the Africa Continental Free Trade Agreement (AfCFTA), Africa is poised to be the largest economic bloc in the world, boosting intercontinental trade and economic diversification.

As organizations recalibrate its supply chain after the COVID-19 pandemic, organizations are looking for more robust and resilient global supply chains.

For organizations that want to incorporate a global supply chain with the involvement of the second biggest continent with 1.3 billion inhabitants, it’s important that companies are aware of the flows of supply chain in Africa.

Understanding the three flows of the supply chain in Africa will make your organization better equipped for growth across the continent.

There are three main flows of the supply chain: products, finance, and information.

Let’s take a look at each one with the African market context

Product Flow

Product flow of the supply chain usually moves in one direction – from producer to customer. Sometimes, with a whole lot of intermediaries in the middle.

83% of trade with African countries comes from international trade with countries outside of Africa. The EU, China, US, and India are the top partners with African countries accounting for 34%, 14%, 9%, and 5% of trade in Africa respectively.

Inter trade – internal trade between African countries – only accounts for 17% of all the trade across the continent.

Majority of African exports are commodities and raw material while imports range from electrical components and OEM parts, to industrial applications, to refined petroleum.

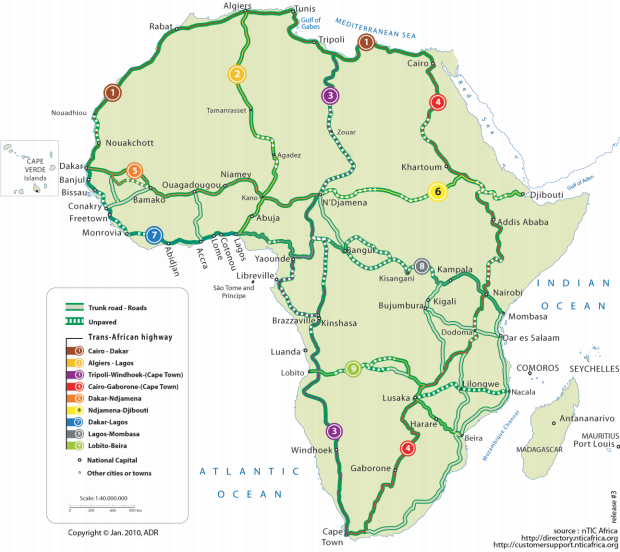

The seaports are the most crucial form of supply chain infrastructure across the African countries for trade. However, for inter-trade between African countries, the road networks play a pivotal role with 90%+ of intra-trade happening via road networks.

However, underdeveloped networks and poor infrastructure continue to hinder product supply flow in Africa and as of 2020, the continent’s infrastructure financing gap weighed in at between $64bn and $108bn a year, according to the African Development Bank (AfDB).

Air transport is also utilized in Africa’s flow of supply chain to overcome the challenges in the road network but it’s a more expensive option that’s mainly utilized for lighter and smaller products.

Producers have to understand where their customers in Africa exist and then prioritize building a robust supply chain for the product to flow easily from them to their customers.

This includes understanding the regions where you should have your top importers, prioritizing markets with access to seaports, good airports, and road networks that connect to other markets.

The cross-continent integration through consolidated economic zones and reduced infrastructure gap is all under the hope and promise of the African Continental Free Trade Area (AfCFTA).

Although the AfCFTA is very promising, most business developers are still neutral to the benefits of its implementation. One of the main challenges of successfully implementing AfCFTA is the issue of multiple currencies across countries.

This brings us to the next flow of the supply chain – the financial flow.

Financial Flow

The flow of finance in the supply chain is similar to the product flow, in that it moves only in one direction. However, it moves in the opposite direction of the product flow with finances moving from customers to producers.

When the producer and customer are in the same country, this flow of the supply chain is not an issue. The producers, distributors, and customers all transact in the same currency.

However, when producers and customers are across borders then it becomes a little more complicated as the flow of money will have to undergo some conversion between customer and producer.

Dependent on currency stability (or fluctuation), that currency conversion can be a loss for either customer or producer.

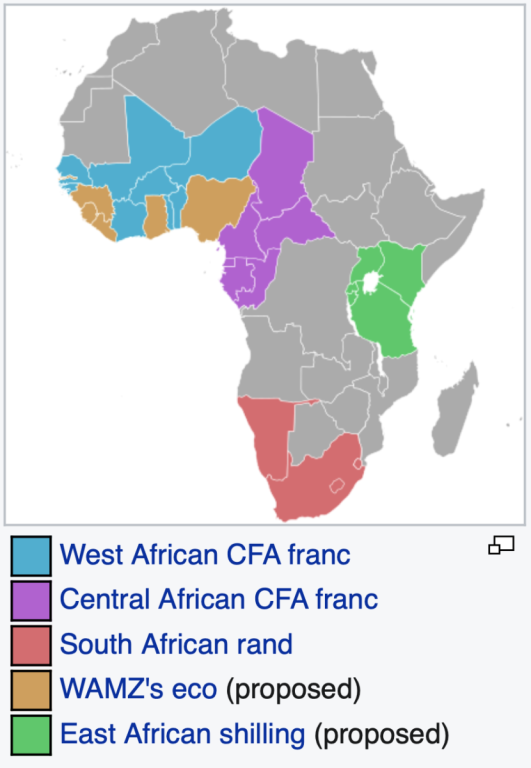

There are 180 currencies used in the world with 41 currencies across 54 countries in Africa. This is also a limiting part of internal trade. For external trade outside the continent, the US Dollar is currently the baseline currency used with international partners.

There are certain regions that have uniformity in currencies. For instance, French-speaking countries in West and Central African use the Francs. This makes commercial interactions between those countries easier. It also makes the external interaction between these countries and France a little more seamless.

Consolidated currencies across countries in Africa

Other countries have to use a currency of global standard (mainly USD) before remitting payment to producers outside their country.

That’s why for any multinational looking to do business in Africa, they have to pay attention to currency fluctuations and this has to be included in their forecasts and sales projections.

You don’t have to be a currency day trader to be able to succeed. You just have to understand the main macroeconomic levers that affect currencies. Political leadership, external debt/GDP ratio, foreign exchange reserves, Central bank managements, and inflation rate.

These are factors to pay attention to in your financial supply chain. As a producer looking to efficiently get the financial flow from your customers with minimum losses, the best option is to work with local intermediaries in your prioritized markets that have access to foreign exchange to make your currency conversion seamless.

You should also prioritize flexible payment schemes for your local partners with payment terms that allows them to manage the shocks of any fluctuation in the local currency.

In the longer term, once you have established your footing in some key markets in Africa, setting up a local entity will allow you to have more control of the financial flow of the supply chain for your business in Africa, as you interface directly with your customers.

Information Flow of Supply Chain in Africa

Unlike the product and financial flow of the supply chain that only move in one direction, the information flow of the supply chain flows in both directions. From producer to customer and the other way around (from customer to producer).

Let’s focus on information flow from customer to producer.

Customer to Producer

Prior to establishing a commercial relationship, producers have to get information about their customers, the target market, distribution landscape, and customer insights necessary to build a strategic plan to gain market share.

After a commercial relationship has been established, the information flow from customer to producer also includes feedback about solution delivery and customer satisfaction.

The flow of information in Africa’s supply chain can be limited and fragmented. Data is not easy to find and is not usually consolidated. A lot of data and market insights collected rely on face-to-face interactions and interviews with industry experts.

For producers that are not in the market where their customers are, they have to rely on a local team or guide that can be the vehicle to gather and transfer this information to them.

Working with a market research team, sales agent, or a local business manager can help you get this seamless flow of information that keeps you properly anchored to the reality on the ground and provides the best approach to build and grow your business.

Now in the other direction, the information flows from producer to customer.

Producer to Customer

Prior to establishing a commercial relationship, producers have to pass on information to potential customers to build awareness. If it’s a B2C business, this comes in the form of brand awareness. If it’s B2B, this comes in the form of introductions and presentations to key accounts.

Once a commercial relationship is forged, producers have to keep the flow of information to their customers seamless. They have to communicate about product delivery dates, product updates, technical guides, training, and maintenance.

This knowledge transfer and information flow is very important to keep your customer base in Africa happy and delighted with your service.

For companies that produce “technically advanced” products such as OEMs, this is particularly important. Since these products require warranties and maintenance, they have to play deeply in this flow of the supply chains to be able to provide effective after-sales service.

Performing after-sales services can really set an organization steps ahead of its competition.

So as an organization is thinking about doing business in Africa, it has to be ready to get entrenched in the information flow of the supply chain to build an effective plan, serve their customer base, and keep them happy with great after-sales service which include providing readily available products and spare parts from the product flow.

When this goes seamlessly, then the financial flow back to your business is more efficient, allowing your team to invest more as you grow your business in Africa.

The three flows of the supply chain in Africa work hand in hand.

As your organization looks towards expansion in the African market, make sure these three flows of the supply chain are clear and build a system that makes each flow work more seamlessly with one another.