In the last article, we did a deep dive into the true cost of running a business in Nigeria with a diesel generator. In this article, we will follow a similar analysis for a solar power solution.

As will be seen, the cost of energy from running a solar system is 35% lower than a generator depending on where in Nigeria you are located.

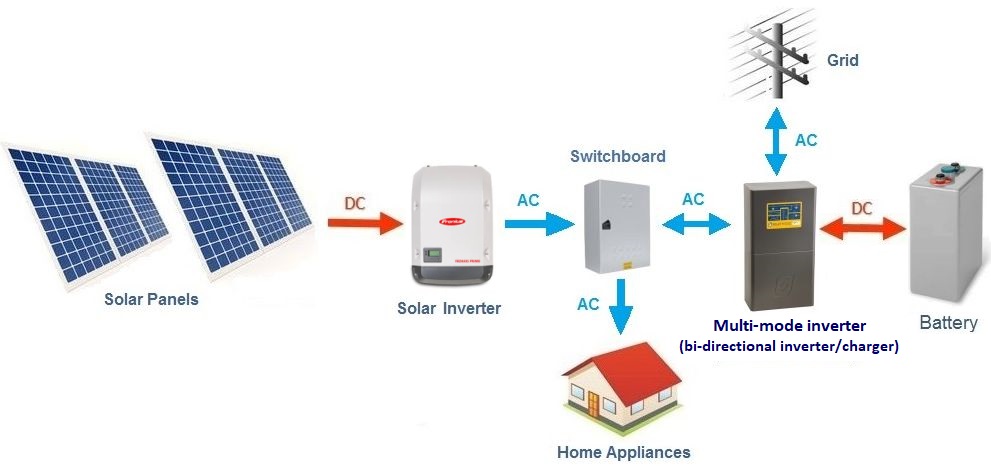

Major components of a Solar system: A solar power system has 4 major components, Solar panels, Solar Inverter, Battery, Battery inverter (Multi-mode Inverter).

- Solar Panels: Solar panels take energy (photons) from the sun and convert it into direct current (DC) electricity. The actual relationship between the nameplate rating of a solar panel and it’s actual power (kW) output can be tricky. To simplify this, let us focus on how much energy (kWh) the solar panel can produce over a year’s period using the Capacity Factor Method. For example, a 70kW solar system with a 20% capacity factor would produce

100kW * 24hrs/day * 30days/month * 80% (losses) * 25% (Capacity Factor) = 10,080kWh/ month

- Solar Inverter: This converts the DC electricity from the solar panels to the AC electricity which can be used to power loads in the office such as air conditioners, computers, and lights.

- Battery: This stores any excess energy generated by the solar inverter in DC electricity.

- Battery Inverter (Bi-directional): This converts the DC electricity from the battery to AC electricity that can be used to power loads when solar is low.

Solar Panel System Cost of Capital:

Owning and operating a solar power solution first starts with capital investment to purchase the system. Raising that initial capital has its cost to a business, either a loan is taken or funds that could have been used in the business is diverted to purchase the generator. This cost of capital (interest rates on loans) differs per business. In Nigeria, it ranges from 15% to 35%.

Most businesses will require a consistent supply of electricity to maximize its productivity. Let’s use a bank (Bank ABC) that requires a constant power supply, as a point of reference in this case.

For our example, Bank ABC is a typical two-story bank branch in Ikeja, Lagos. Due to Misaligned Incentives and challenges in Nigeria’s power industry, a typical Bank branch only has 20% supply from the power grid.

To make up for the difference it would purchase a 70kW solar power system with a 70kWh battery for a branch location to ensure it can carry out business. This solar system would produce up to 10,080 kWh of energy month which is above the 9,450kWh of energy monthly needed to power the bank (see The true cost of running a diesel generator for more detailed calculation).

With prime lending rates ranging from 15% to 35% in Nigeria, let us assume a 25% cost of capital for this solar system and a purchase price of NGN 28M (NGN20M for the solar component and NGN 8.0M for the battery component).

This means that each month, as a business, you will have to expense NGN 585,520 in monthly costs until the loan is repaid.

Item

Description

Cost/month

Cost of Capital – 25%

25% annual cost of capital for a 70kW/70kWh solar system with NGN 28.0M purchase price

NGN 585,520

Asset Depreciation:

Once the solar system is purchased, it becomes an asset to the business. However, this asset depreciates over time and hence a depreciating cost must be accounted for.

For a solar system, the Solar component has a 20-year useful life, while the battery component has a 10-year useful life.

For this example, we shall assume a straight line depreciation, i.e. the solar system’s value depreciates to its salvage value (or zero) by the same amount each year. Including this as a line item adds an additional cost of NGN 150,6360 per month.

Item

Description

Cost/month

Cost of Capital – 25%

25% annual cost of capital for a 70kW/70kWh solar system with NGN 28.0M purchase price

NGN 585,520

Solar System Depreciation

NGN20M for the solar component over 20 years. NGN8M for the battery component over 10 years.

NGN 150,6360

Solar Power System Maintenance:

To ensure optimal performance of the solar system, regular maintenance must be carried out. Typical maintenance includes cleaning of the solar panels with water and a cleaning cloth. This cost can vary from NGN 500 to NGN 1000 each month depending on the cost of manpower (unskilled labour).

Item

Description

Cost/month

Cost of Capital – 25%

25% annual cost of capital for a 70kW/70kWh solar system with NGN 28.0M purchase price

NGN 585,520

Solar System Depreciation

NGN20M for the solar component over 20 years. NGN8M for the battery component over 10 years.

NGN 150,6360

Solar System Maintenance

Average monthly maintenance cost

NGN 1,000

Fuel Cost:

The fuel for a solar system is the sun, this is currently free, untaxed and not burdened by changes in inflation.

Item

Description

Cost/month

Cost of Capital – 25%

25% annual cost of capital for a 70kW/70kWh solar system with NGN 28.0M purchase price

NGN 585,520

Solar System Depreciation

NGN20M for the solar component over 20 years. NGN8M for the battery component over 10 years.

NGN 150,6360

Solar System Maintenance

Average monthly maintenance cost

NGN 1,000

Fuel Costs

Free

NGN 0

Total

Monthly energy consumption of 10.080kWh equates to Levelized Cost of Energy. NGN 73.13/kWh or USD0.20/kWh

NGN 737,159

35% the cost to run a generator:

In summary, an average business in Nigeria would spend about NGN 737,159 a month to own and operate its solar system. This equates to an effective cost (aka Levelized Cost of Energy – LCOE) of NGN 73.13/kWh produced. This is 35% the average cost of getting electricity from a diesel generator which is NGN 113.36

It is important to note that this calculation relies on 2 main variables

- Location in Nigeria. If the system was located in Kano, the capacity factor would be closer to 28%, hence for the same investment you would get more value

- Cost of Capital: For a long term asset such as solar system, it is common to raise capital at lower rates such as 15%. This would reduce the monthly cost of capital