As the manager of a multinational company who is looking to enter the Nigerian market, you are most likely already aware that Nigeria boasts many opportunities for growth for new businesses in the region. With that said, it is important that you educate yourself on industrial and consumer goods sector in Nigeria to better understand the ways in which your company can succeed in this new market.

By learning how sectors dealing with industrial and consumer goods in Nigeria operate, you will be able to strategically adapt your products and prices to meet the needs of the local market in Nigeria. Therefore, you should use the information provided in this article to inform your strategic plan, thereby furthering your business’s success.

The Relationship Between Industrial and Consumer Goods

The industrial goods industry primarily deals with the process of creating goods. Therefore, various sectors, such as manufacturing and machinery, typically fall into this category. Meanwhile, the consumer goods industry contains finished products that are available for public consumption.

Since these two sectors are very much intertwined, the demand for industrial goods is usually informed by the demand for the consumer goods they help produce. Therefore, in order to fully understand the demand and opportunities for industrial goods in Nigeria, it is necessary to have a good understanding of the demand for consumer goods in the Nigerian market.

Current Sector Landscape

After the recovery of the Nigerian economy from a six-quarter-long recession, which ended in 2017, the consumer goods market is back on track to trend upwards, as Nigeria is predicted to become one of the Top 20 economies in the world by 2030.

The three main trends driving this growth are a youthful population that is eager to try new products and brands, resides in large cities, and has access to mobile phones that can facilitate payments and money transfers. This population makes it possible for multinational companies, such as yours, to take advantage of long-term opportunities in Nigeria.

With that said, Nigeria is still a nascent economic market, so the mass market reflects the needs of the country’s population by providing mainly necessities, such as choices in food, clothing, and shelter. Therefore, opportunities for consumer goods in Nigeria, such as home & personal care products, apparel, real estate, and automobiles – to move people around – are apparent and pervasive given that these things are seen as a necessity amongst the country’s large population.

Consumer Goods

Consumer goods are classified into two sub-categories: durable goods and non-durable goods. Durable goods have a significant lifespan of three years or more. Due to the fact that a durable good lasts a fair amount of time, these items are typically in need of maintenance during their lifespan. Examples of durable goods include cars, furniture, and electrical appliances.

Non-durable goods are goods that are purchased for immediate consumption or use, and they typically have a lifespan that is shorter than three years. Food, beverages, and clothing are examples of non-durable goods.

As Africa’s most populous country with 186 million inhabitants, Nigeria hosts a sizable consumer market for both local and international companies. Furthermore, as Nigeria’s burgeoning middle class continues to grow, the country will also see significant growth in its retail, industrial and consumer goods sector.

Currently, retail and wholesale sales make up 16 percent of Nigeria’s GDP, making retail and consumer goods sales the third largest contributors, even though most of these sales are conducted through informal markets, such as open-air markets and kiosks.

Local manufacturing accounts for 8.7 percent of Nigeria’s GDP and is mainly driven by the food and beverage sector, which constituents 65 percent of manufacturing in Nigeria. With a rising consumer class, many multinational companies are using this as an opportunity to meet the needs of the growing consumer class with consumer-packaged goods (CPG).

Industrial Goods

Since the demand for industrial goods is a “derived demand” and is, therefore, driven by the demand for consumer goods, one only has to look at the growing consumer class in Nigeria to assess the demand for industrial goods.

The opportunities for industrial and capital goods include equipment used in the industrial and manufacturing sectors, such as machinery, fluid controllers, power tools, chemicals, IT hardware, and raw material inputs. Other industrial goods opportunities outside of the industrial sector include automotive spare parts, construction material, and household fixtures, such as lighting, piping systems, and paints.

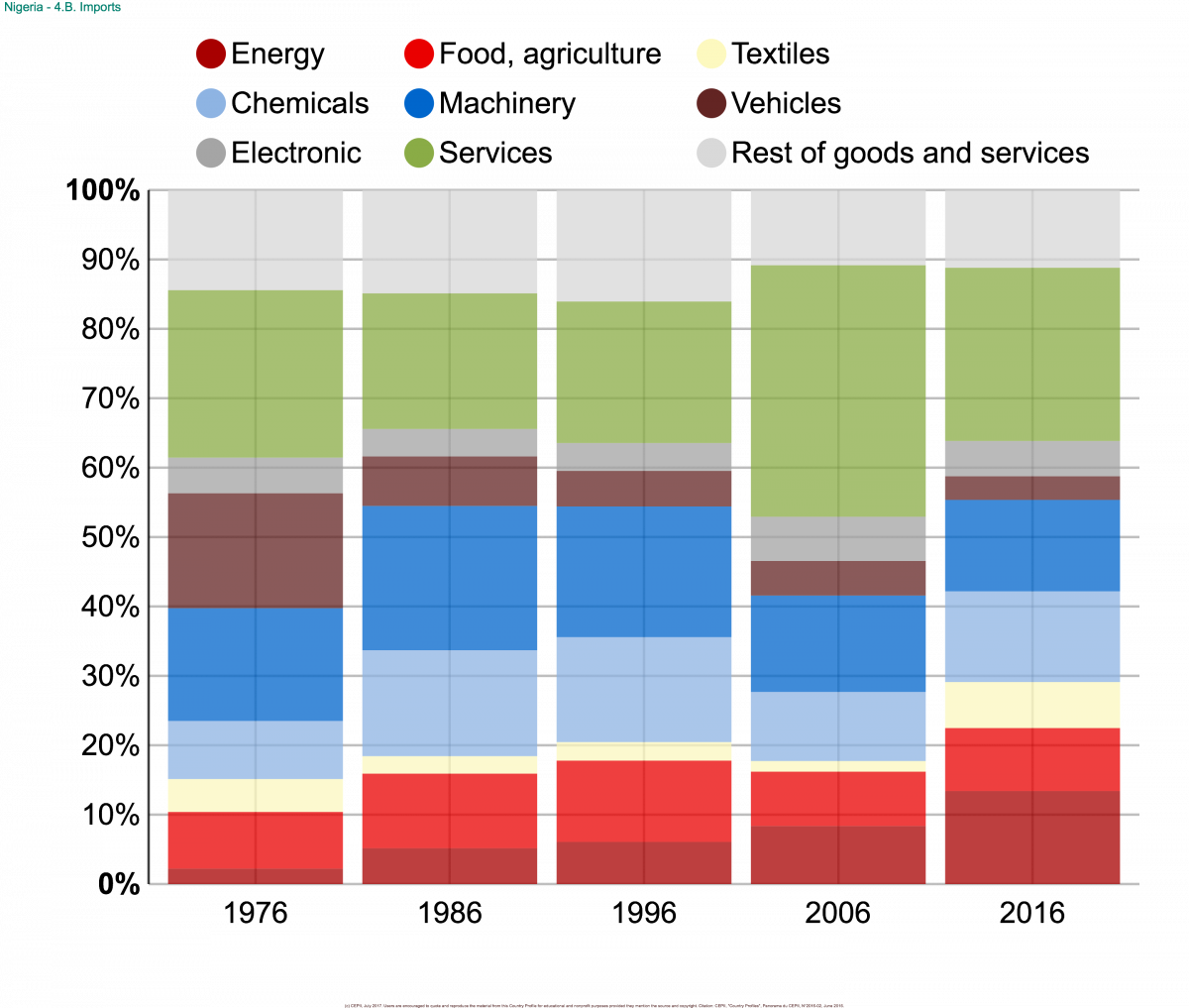

As the consumer goods market continues to grow, so will the industrial goods market. However, even though Nigeria is a very large market with a relatively untapped labor force, most of the goods consumed in Nigeria aside from food and beverages are imported from foreign countries, thereby making Nigeria a very import-dependent country.

Being an import-dependent country has its advantages and disadvantages in regards to suppliers of industrial and capital goods. The main advantage is that without a well-developed manufacturing industry, local companies are unable to make industrial goods, which bodes well for companies looking for new markets to expand into.

Meanwhile, the primary disadvantage is that without a well-developed industrial sector, there is limited demand for equipment and pieces of machinery that are used within the manufacturing industry. However, this does not apply to industrial goods that are used outside the manufacturing sector. For instance, the demand for industrial goods, such as automotive spare parts, household fixtures, and construction material are all dependent on the Nigerian consumer’s need for automobiles and houses respectively.

The Public Market As A Growth Indicator

The industrial and consumer goods sector of the Nigerian Stock Exchange (NSE) shows the highest growth rate among other sectors thus far in 2018. The NSE Industrial Goods Index, which appreciated 23.8 percent in 2017, has recorded a growth of 18.9 percent so far this year. It has outperformed the NSE Banking Index, which currently has recorded a growth of 9.3 percent.

Therefore, even with the major challenges in the industrial and consumer goods sector that most companies will have to overcome, according to the present trends in the public market, the opportunities for growth in this sector look very promising.

Conclusion

Now that you have a better idea of the current state of the industrial and consumer goods sector in Nigeria, use the insights here to inform your decision-making and build resilient strategies to reach your target customer base. Doing so will allow your business to thrive as a new entrant in the Nigerian market.