As the manager of a multinational firm, you’re aware of the fact that there are always risks associated with opening a new business or entering a new market. Therefore, before entering the Nigerian market, it’s imperative that you understand the risks of doing business in this region by first familiarizing yourself with Nigerian currency, as well as the country’s policies and economic standing.

It’s also important that you make plans that take potential pitfalls into account in an effort to mitigate risk entirely. While there are probably several risks you’ve considered as your company establishes itself in the Nigerian market, issues stemming from foreign exchange risk are most likely chief among them.

Understanding Nigerian currency will allow your company to mitigate currency risks caused by changes in the Nigerian economy, country policies, or political unrest. Highlighted below is information pertaining to Nigerian currency and how to mitigate risks associated with it.

The Naira: A Brief History

The Naira is the official currency of Nigeria and is also subdivided into 100 Kobo. The Naira was introduced on January 1, 1973, when it replaced the British pound at a rate of two Naira per one British pound. On February 11, 1977, the 20 banknotes were issued, making it the highest Naira banknote to be issued at the time, as well as the first Nigerian banknote to feature a Nigerian citizen.

The Central Bank of Nigeria (CBN) controls the amount of money issued in the economy to maintain monetary and price stability in the country. This organization is also the only issuer of legal tender money throughout Nigeria.

Currency Depreciation

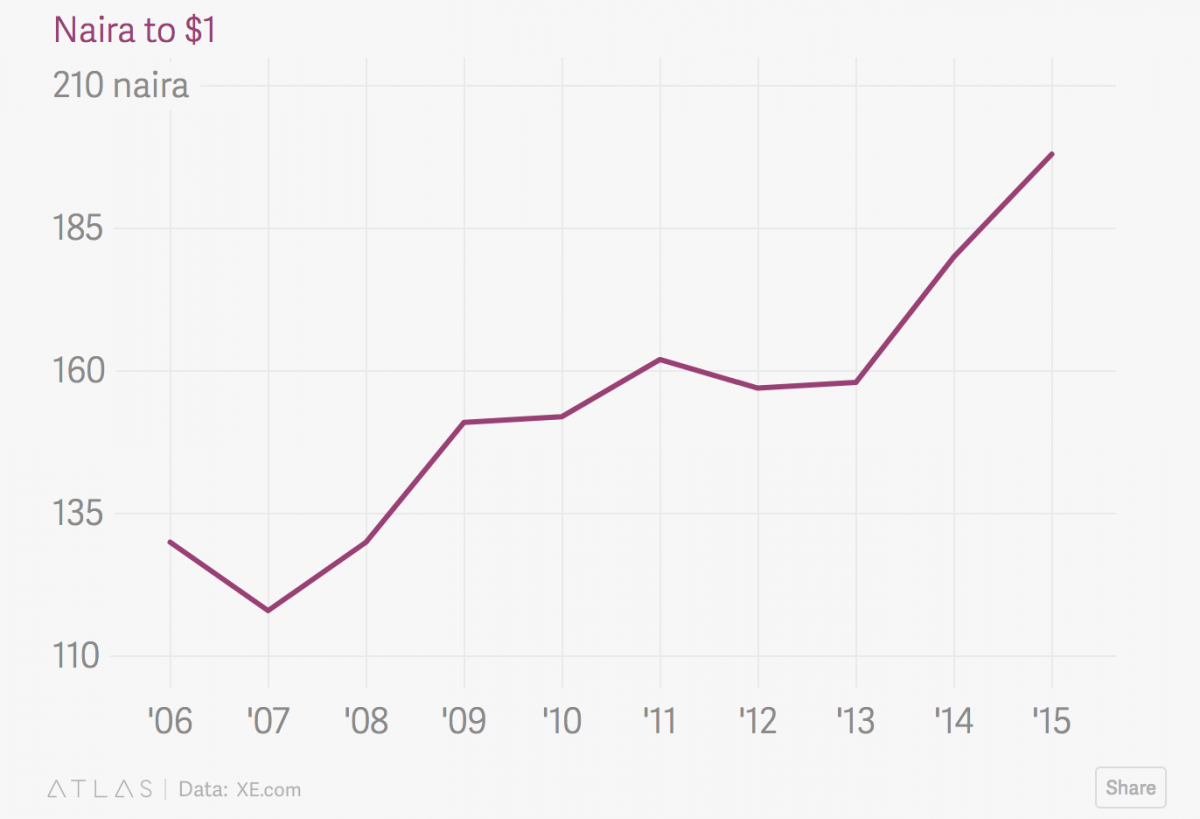

The Nigerian Naira has steadily lost its value since the 70’s as Nigeria was ruled by one military regime after another, accumulated foreign debt, and depleted its financial reserves while functioning in an economy that is highly dependent on revenue from crude oil exports. After Nigeria returned to democratic rule in 1999, the currency devaluation continued. By 2014, the Naira was at N180 per USD$1.

The Early Days of the Recession

When oil prices collapsed globally in 2014, so did the Nigerian economy, as the exportation of oil accounted for over 90 percent of Nigeria’s total export revenue and was, therefore, crucial to the country’s economic health. The collapse of oil prices marked the beginning of an economic recession for Nigeria, the country’s first since 1991. Furthermore, due to the depletion of financial reserves and a shortage of foreign exchange currency, the Nigerian Naira continued to decrease in value as the recession progressed.

Recession, Devaluation, and Multiple Exchange Rates

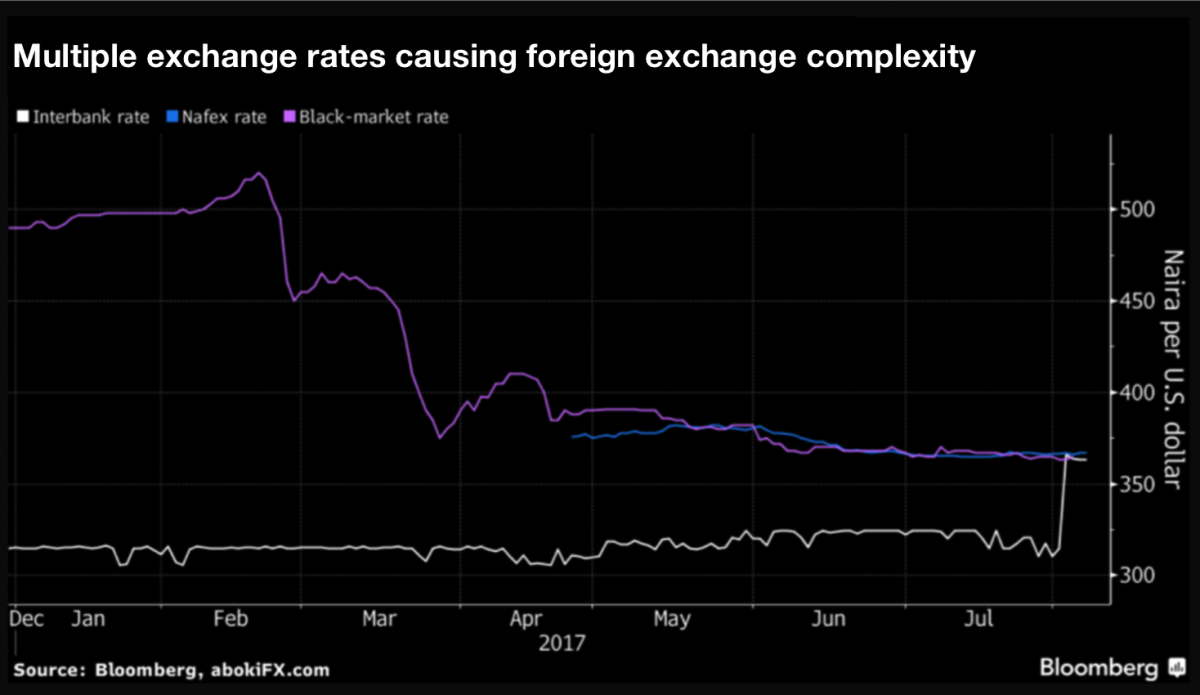

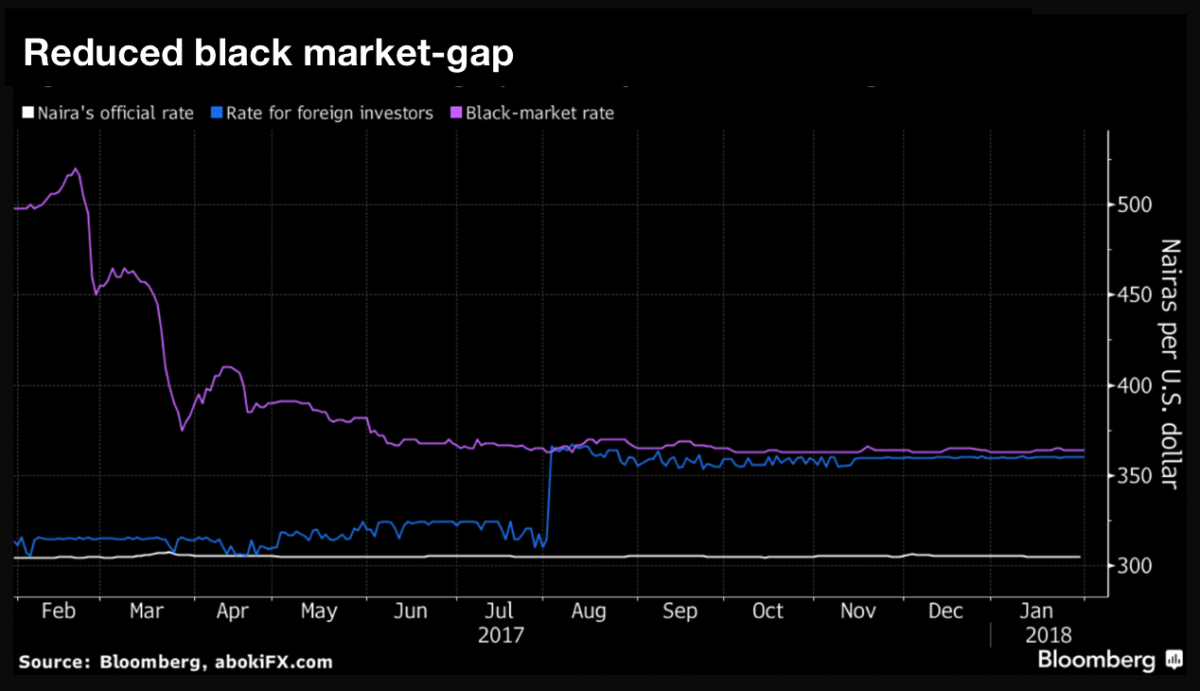

During the recession, the Naira’s value dropped from N180 to as low as N500 per USD$1. The policy put in place by the Central Bank of Nigeria to “peg” the exchange rate caused a huge gap between the official exchange rate and the black market exchange rate. This disparity caused a significant rift in the market, which has ultimately deterred foreign entities from investing in the Nigerian market. Furthermore, local businesses involved in trading with international partners have also been adversely affected.

The Effects of FX on Local and Foreign Businesses

The limited access to foreign exchange currency has reduced the number of imported products, increased the price of goods in a price-sensitive market, and adversely affected repayment plans to international partners. The Nigerian Autonomous Foreign Exchange Rate Fixing (NAFEX), which is also known as the “Investors’ and Exporters’ FX Window,” was introduced in April 2017, in an effort to establish more foreign exchange liquidity and stability for Nigerian businesses and investors involved in international trade. However, even though the new policy has brought about a reduction in the disparity between the multiple exchange rates, it has also added to the complexity of the currency regime in Nigeria and continues to be a major risk that international companies have to take into account when doing business in Nigeria.

How to Mitigate Currency Risks

Since Nigeria is still heavily dependent on oil revenue, it is important that you keep an eye on global oil prices to understand Nigerian currency will trend. Commodities prices, along with remaining abreast of what’s occurring politically in Nigeria, will give you a good sense of the volatility of the Naira.

Aside from keeping up to date on current events, you should also practice basic mitigation tactics, such as using forward contracts to lock in exchange rates, maintaining the same currency in all transactions, looking to see if the companies you’re investing in are using expense and revenue hedging strategies, and reviewing your company’s operating cycle to locate where foreign exchange risk might exist. You should also calculate your foreign exchange risk and develop procedures to manage this risk accordingly. This forward-thinking will allow your company to be proactive rather than reactive if any issues regarding foreign exchange arise.

Conclusion

As a new entrant in the Nigerian market, it’s imperative that you learn more about risk mitigation as it pertains to Nigerian currency and the effect other factors could have on said currency and, ultimately, your business. In becoming informed about the past, present, and potential future of Nigerian currency, you will be able to devise a plan that will help your company mitigate risk and establish a thriving business in this emerging market.