In 2019, Nigeria spent over NGN1 Trillion on subsidizing petrol imports into the country. These funds could be used to finance much-needed power projects across the country.

For background: A subsidy is a form of financial aid or monetary support extended to an economic sector (or institution, business, or individual) generally with the aim of promoting economic and social policy.

As a country blessed with an abundance of crude oil – enough to make it self-sufficient – it comes as no surprise that the government subsidizes petrol as an effort to reduce prices for its citizens However, it is prudent to ask what else could the country do with NGN1 Trillion in a year?

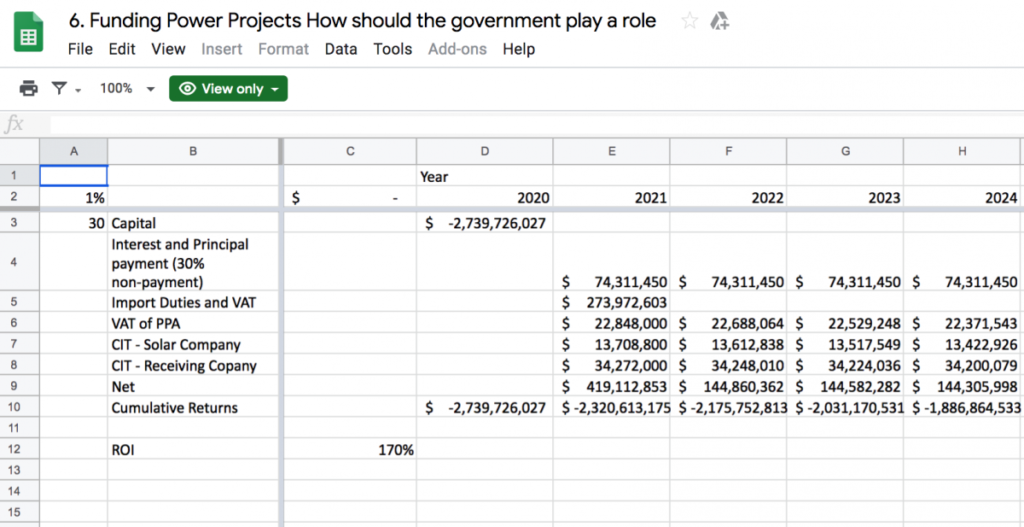

In this case study, I walk through a scenario where a N1 Trillion (~USD2.7 billion) 30-year non-collateralized debt facility is created for funding solar power projects for industries. Use this spreadsheet to follow the analysis line by line broken down from the year 2020 – 2051.

As you will see, the cascading benefits to Nigeria would reap a 170% Return on that investment, even with a 30% default rate on the loans to these power projects.

In the analysis that follows, I’ll breakdown this investment into its separate line items in this spreadsheet – loan repayment rate, import duties, VAT, and Tax paid – on an N1 Trillion solar power projects to illustrate how exactly the returns will be accrued over the years.

Initial Investment: A NGN1 trillion fund – assuming an exchange rate of 365 Nigerian Naira to 1 USD – would equate to USD 2.74Billion, which would be given to indigenous solar power companies as a non-collateralized loan to fund the building of up to 1GW power facilities.

These power projects will install solar-battery hybrid systems capable of powering multiple industries. For comparison, an average factory would need about 1MW, hence equating to 1,000 factories to be powered by this loan facility.

The solar power companies would enter a Power Purchase Agreement (PPA) with the individual factories, in which the factories pay for electricity consumed. The revenue generated would be used to pay back the loans and subsequently provide profit to the solar power companies.

Repayment of loan on power projects: To promote the speedy deployment of the facility, we shall remove the infamous collateral requirement – non-moveable collateral or landed property – for access to loans which Nigerian institutions require. In this scenario, collateral would not be required to access the loan for these power projects and we shall account for this risk by assuming a 30% default rate on the loans.

Import Duties and VAT: For simplicity, let us assume a straight 5% duties and 5% VAT on the importation of the equipment. For comparison, Solar panels imported currently for local power projects have a 5% duty charge, while batteries have a 25% duty charge.

The VAT on payment of PPA (Power Purchase Agreement): Unlike diesel/petrol sales which have zero VAT, services have a 5% VAT in Nigeria. Hence the payment of the PPA from the factory to the solar power company would generate 5% VAT for the government.

Corporate Income Tax (CIT) of the solar power company: Assuming the solar power company makes a 10% profit annually, we shall tax that at 30% CIT.

Corporate Income Tax (CIT) of the additional profit from the factory: Assuming the savings generated after moving to solar directly correlates to additional profit. A 30% CIT is imposed on this profit.

Conclusion: If Nigeria created a N1Trillion fund instead of subsidizing the import of petrol, this would result in an ROI of 170%, 1GW of new renewable energy generation facility, and a self-replenishing fund which can be reinvested into further facilities and future power projects to increase the number of power plants installed in the country and increase the productivity level for the economy.