There are various ways to invest and make money in the stock market, however there are two basic approaches, fundamental and technical, to participating in the market.

Fundamental approach involves using companies’ revenue, earnings, and future growth outlook to make investing decisions

Technical approach involves making investment decisions based on historical price chart patterns

Personal interests, sentiments and individual levels of risk-taking are some of the many other factors that influence investing styles and strategies.

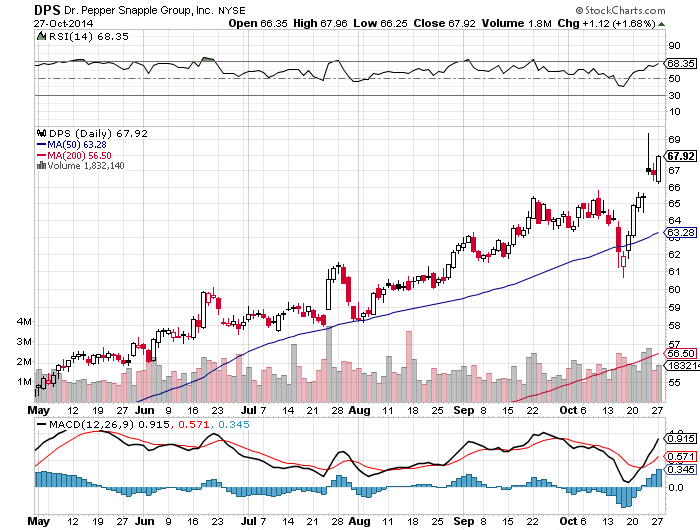

As a full-time active investor, my preferred style is a mid to long term technical approach to investing. My view is that fundamentals as well as human sentiments are included in the make-up of the historical price of a stock. As shown in the sample stock chart below.

This approach enables effective risk management, in that I am able to estimate potential risks & rewards of every stock trade I make.

Liquidity is very important when utilizing the technical investing approach so I essentially stick to stocks within the S&P 500, NASDAQ100 and DOW 30. The simple strategy is to buy only when the price is above the 200 Moving Average.

A more passive investor (i.e. someone who doesn’t trade stocks for a living) may prefer the fundamental approach to trading because precise entry and exit is not key to this investing style.

Remember whichever style of investment approach you take, the first three rules applies:

#1 – Do not be reckless with your capital

#2 – Do not forget rule #1

#3 – Only take positions that you (not others) are comfortable with

*** This is not an investment advisory but a personal opinion of an active investor

Happy Stock Trading!